Would You Pay £336,000 for Coffee?

- Joe Woodhouse

- Sep 28, 2020

- 2 min read

How many coffees a day do you drink? I’m talking Starbucks, Costa, Mug & Bean, Neros, Tim Hortons (for our canadian readers), and all those other expensive Hipster chains of coffee houses where you spend £4 on a drink?

Let’s say you have 1 a day, 5 days a week. That’s £20 a week, or £87/month. What if you invested this, and left it.

And let’s say from the age of 20 you stopped buying expensive coffee and instead, invested this amount. What would that do for you?

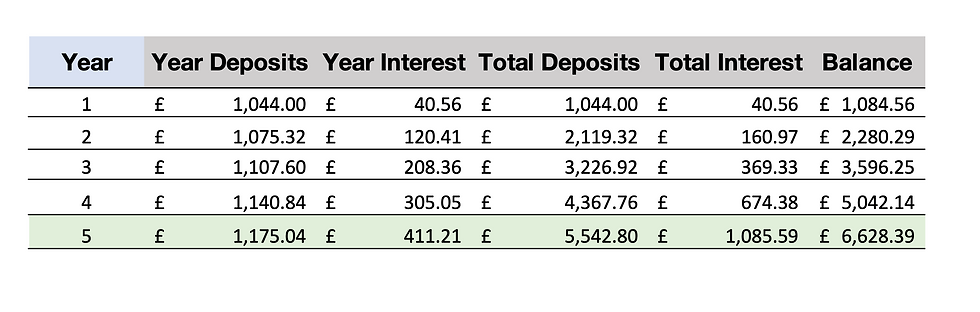

Ok so assuming you just invested into the US Stockmarket, which pretty much mirrors the global stock market, And you got on avg. 7% a year (which it’s done on avg since 1980) and every year as the price of coffees goes up, i.e inflation, you also increase your savings by a couple of quid to compensate for this:

In just 5 years your £4 a day would turn into £6,628

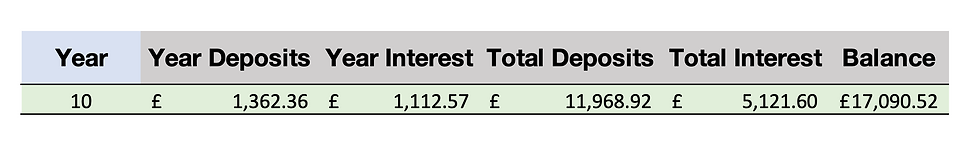

In 10 years: £17,090 - That's a new car!

15 Years: £33,16 - That’s a house deposit.

20 Years: £57,384 - that’s a big dent off your mortgage when you’re 40 years old

30 Years: £146,419 - If you have kids in your early 30s, as I have done, that’s 1 of their degrees paid for, out of just not drinking as much coffee!

Or say you leave it and don’t touch it when you’re 50 but you just keep putting your coffee money away each and every month into the stock market;

40 Years on: £336,320. Cold. Hard. Cash

The average pension pot today in the UK is less than £72,000

So just from not drinking coffee and the magic that is compounding, you’ve more than quadrupled the UK average sized pension.

Makes you think doesn’t it?

Thanks for reading,

Comments